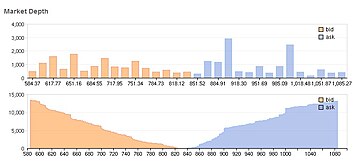

Infinance, market depth is a real-time list displaying the quantity to be sold versus unit price. The list is organized by price level and is reflective of real-time market activity. Mathematically, it is the size of an order needed to move the market price by a given amount. If the market is deep, a large order is needed to change the price.[1][2]

In some cases, the term refers to financial data feeds available from exchanges or brokers. An example would be NASDAQ Level II quote data.

Types of markets

Types of stocks

Participants

Trading venues

Trading theories

and strategies

Related terms